Market data hits your platform milliseconds too late. Fraud alerts arrive after the money's gone. Process at the source. Decide faster.

Millions of trades generating data every millisecond.

Multiple exchanges with incompatible data formats.

Delayed insights costing trading opportunities.

Compliance teams buried in manual data governance.

Market and transaction data needs alignment, qualification, and governance for AI-powered trading.

Learn About AI-Ready Data →Add semantic meaning to market feeds. Convert raw tick data to structured, analyzable formats.

Enforce data quality at the trading desk. Route anomalous transactions for review automatically.

SOX and GDPR compliance before data moves. Data sovereignty enforced by jurisdiction.

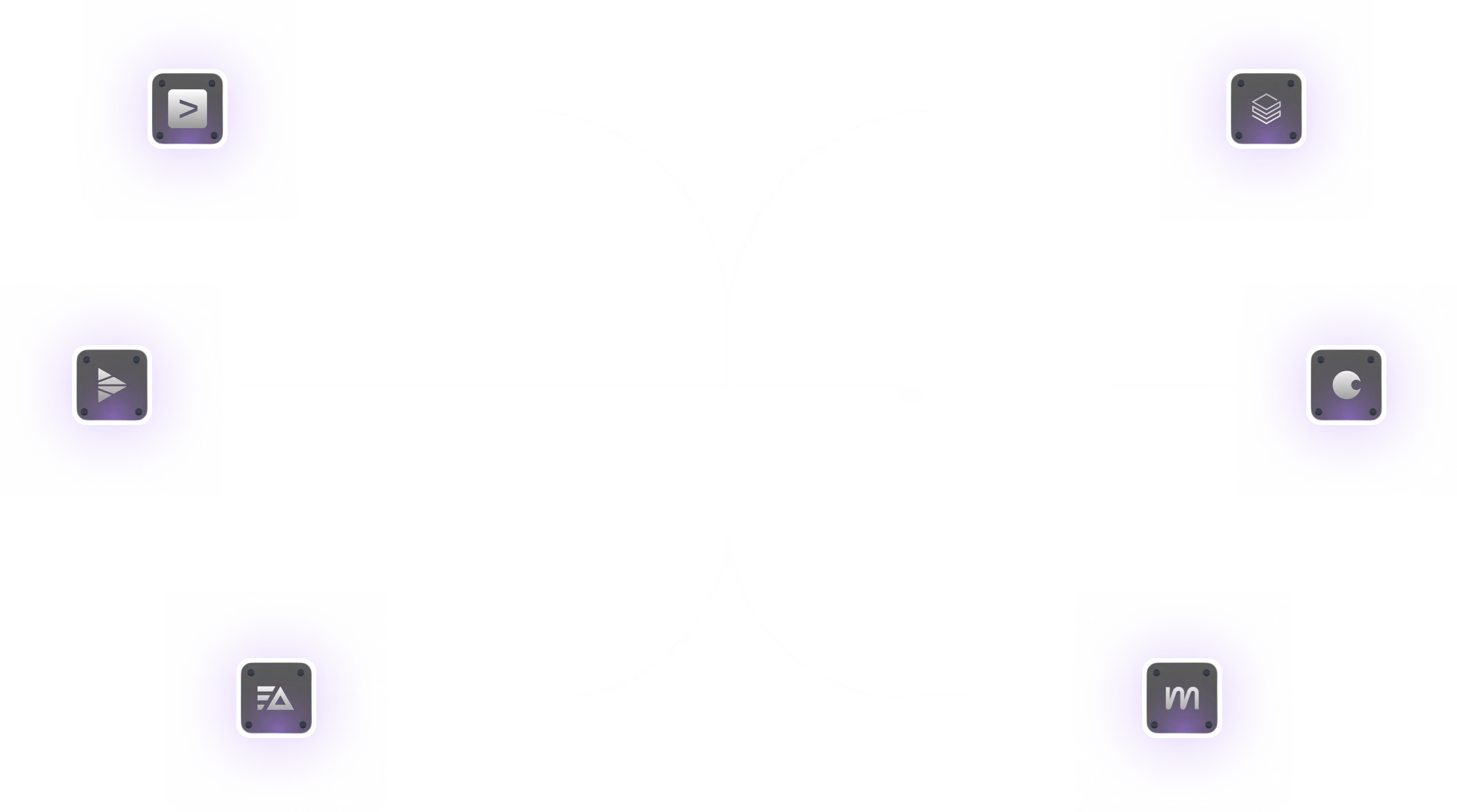

Snowflake for analytics. Databricks for AI. Splunk for security. Datadog for observability. Expanso sits upstream - sending clean, governed data to all of them.

Expanso filters out the noise at the edge before it ever reaches your data lake. Use our ROI calculator to see how much you could save.

Expanso automates SOX, GDPR, and regional financial compliance by processing market data at the source with built-in governance. All data transformations maintain complete audit trails with lineage tracking, providing evidence for regulatory audits. Regional data stays in jurisdiction, preventing cross-border compliance violations.

Yes. Expanso processes millions of trades per second at the edge with microsecond latency. By filtering and aggregating market data at the source, we reduce downstream platform costs by 60% while maintaining real-time trading analytics and risk calculations.

Bloomberg, Refinitiv, direct exchange feeds, FIX protocol, Kafka, Kinesis - plus downstream platforms like Snowflake and Databricks. The value isn't the list of connectors. It's that we normalize the data before it hits your systems. Your Bloomberg and Refinitiv feeds arrive in different formats with different latencies. We make them look the same to your trading platform.

Expanso processes transaction data in real-time at the edge, running ML models that detect suspicious patterns as they happen-not hours later. Immediate fraud alerts trigger while all transactions maintain full audit trails for compliance and investigation.

Yes. Market data processes locally in each jurisdiction, complying with local regulations while enabling unified analytics. No sensitive data crosses borders without compliance approval. Global operations, regional sovereignty.